Apple Versus Samsung’s Winner Is TSMC: Riskless Return

By Tim Culpan - Feb 27, 2013 1:11 AM GMT+0800

TSMC gets $7 in sales for every smartphone sold worldwide, according to Chief Executive Officer Morris Chang, because it’s the only company with the technology to make the chips used in the latest handsets. That ubiquity let Hsinchu, Taiwan-based TSMC post the best risk-adjusted returns among the world’s top 20 chipmakers over the past three years, according to the BLOOMBERG RISKLESS RETURN RANKING. It also beat Apple, Samsung, Nokia Oyj and ZTE, the biggest smartphone makers.

| Sponsored Links | |||||||

| Buy a link | |||||||

Shares of the world’s largest contract maker of chips doubled in Taipei over the period and had the lowest volatility as the company was unaffected by market share swings between smartphone-makers that sold 722 million units last year. TSMC’s size and financial strength means it can maintain a technology lead of at least 12 months over rival outsourcersUnited Microelectronics Corp. (2303) and Globalfoundries Inc.

“As long as smartphones are growing, TSMC wins,” Jeffrey Toder, a Taipei-based Royal Bank of Scotland Plc analyst, said by phone. “TSMC is the single most dominant supplier across all products.” He rates the company hold.

TSMC makes chips designed by clients including Nvidia Corp. (NVDA), Qualcomm Inc. (QCOM), Texas Instruments Inc. andBroadcom Corp. (BRCM) The components it produces include ones that let Apple iPhones and Samsung Galaxy devices control touch-screen displays and communicate with mobile networks.

Tablet Computers

The company’s grip also extends to tablet computers. It gets about $11 from every one sold worldwide, according to Chief Financial Officer Lora Ho. Global smartphone sales will probably rise 22 percent this year, with tablets climbing 41 percent to 172 million units, according to forecasts from Bloomberg Industries and IDC.

TSMC’s Taipei-listed shares returned 4.7 percent when adjusting for volatility in the three years ended Feb. 25. That’s ahead of Cupertino, California-based Apple, which posted an adjusted return of 4.2 percent and Samsung’s 3.7 percent. Qualcomm, the second-best performing dedicated chipmaker, rose 3 percent on an adjusted basis. Intel Corp. (INTC), the world’s biggest chipmaker, had a 0.3 percent return as it missed out on the growth in mobile devices.

Risk-adjusted return is calculated by dividing total return by volatility, or the degree of daily price variation, giving a measure of income per unit of risk. The returns are not annualized. Higher volatility means the price of an asset can swing dramatically in a short period, increasing the potential for unexpected losses.

Low Volatility

While TSMC’s cumulative 105 percent gain in the three years trailed Apple’s 122 percent increase, it topped the ranking because its volatility of 22.1 was the lowest of all suppliers and smartphone makers surveyed. TSMC’s New York-listed ADRs (TSM) also posted lower volatility than Apple’s 28.9 score and Suwon, South Korea-based Samsung’s 30.5.

Its Taiwan shares have advanced at more than six times the pace of the MSCI World Technology Hardware & Equipment Index (MXWO0TH) over the past three years. Still, the shares aren’t trading at a big premium compared to the index: TSMC’s shares have a price- to-earnings ratio of 16.2, compared with 14 for the MSCI World Technology Hardware & Index, according to data compiled by Bloomberg.

Since Apple’s founder Steve Jobs put the iPhone on sale in June 2007, TSMC has had an adjusted return of 2.9 percent. That’s the best performance among pure chipmakers, helped by the lowest volatility among all companies surveyed. Apple had a 6.9 percent adjusted return in the period and Samsung posted 5.2 percent. Hon Hai Precision Industry Co. (2317), the Taipei-based flagship of Foxconn Technology Group which assembles iPhones and iPads, had a negative return of 0.82 percent.

Rising Profits

TSMC’s annual net income rose 86 percent over the past three years because of surging demand for smartphones and tablets. It forecast sales this quarter that surpassed analyst estimates. UMC, the world’s second-largest contract maker of chips, unexpectedly predicted a first-quarter operating loss after failing to keep pace in mobile-phone chips.

“TSMC is now being viewed as a profitable growth company, whereas previously it was seen as just a profitable company,” CFO Ho told Bloomberg News last month.

Its sales are more than four times the size of Hsinchu, Taiwan-based UMC’s. Its net income margin, a measure of how much of its sales a company actually keeps in earnings, is 32.8 percent, higher than 97 percent of 50 global peers by value, according to data compiled by Bloomberg. Its ratio of debt to earnings before interest, taxes, depreciation and amortization, or Ebitda, was 0.37, lower than 82 percent of peers, at the end of last year. The company sold NT$21.4 billion of bonds last month.

Spending Plans

Chang, TSMC’s 81-year-old founder, plans to spend $9 billion defending the company’s leading position this year, adding capacity and improving technology. The investment means the company can make more-powerful chips at smaller sizes. Its shipments of 14 million 8-inch wafers of chips last year was three times UMC’s tally. Globalfoundries is unlisted.

TSMC has grown as clients shun the risk and cost of building their own factories. Neither Qualcomm nor Nvidia, the biggest designers of mobile processors, operate factories. Instead, they contract production to TSMC and UMC. Texas Instruments (TXN), the largest maker of chips that convert sound and video for use in electronics, and Broadcom also outsource production to chip foundries.

“If you’re looking at jostling between Qualcomm and Nvidia, it doesn’t matter because they’re both TSMC customers,” said RBS’s Toder. “If TSMC were shut down tomorrow, there’s not enough capacity in the world to make up for it.”

28 Nanometer

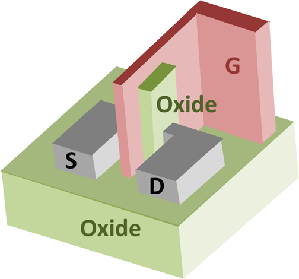

Demand for the latest 28 nanometer production technology spurred it to spend $8.3 billion last year, 38 percent more than originally planned, as the industry struggled to keep pace. One nanometer, equal to a billionth of a meter, measures the size of connections in a chip with smaller metrics being more advanced.

Customers were unable to turn to alternative suppliers because of TSMC’s lead in the technology. Nvidia lost “a lot” of revenue in the second quarter of last year, CEO Huang Jen- hsun said in May. Qualcomm also predicted lower than expected profit as smartphone makers delayed new models because of the lack of chips. The shortage was over by last month, according to Qualcomm CEO Paul Jacob.

Samsung Risk

TSMC could face a risk from Samsung, the world’s biggest maker of smartphones. The Korean company, which already makes most of its own components including displays and memory chips, is boosting production of its own mobile processors. Extending this push into areas where it’s relying on outside designers could take work from TSMC.

“If Samsung uses more in-house components, then other chip designers like Qualcomm won’t be getting orders and TSMC won’t be needed to manufacture them,” said George Chang, who rates TSMC buy at Yuanta Financial Holding Co. in Taipei.

At the same time, TSMC could benefit from an Apple push to pare its reliance on Samsung. Apple uses Samsung-made processors in iPads and iPhones, even though the Korean company sells competing smartphones and tablets.

TSMC could progressively replace Samsung as maker of the A- series processors used in Apple devices, Sanford C. Bernstein analyst Mark Li said in a Jan. 28 report. That could bring in $2.5 billion of revenue over the next three years, he wrote.

Mobile Focus

The Taiwanese company is also less reliant on the slowing PC market than Intel, the biggest maker of chips for desktop computers. PC sales will likely climb 1 percent this year after falling 3.2 percent to 352 million last year, according to International Data Corp. figures compiled by Bloomberg Industries. Sales have slowed on competition from tablets.

“Mobile devices like smartphones and tablets are what’s driving the technology industry now and for the next few years,” said Jitendra Waral, a Hong Kong-based Bloomberg Industries analyst, in an interview. “That is where the supply chain will find its growth.”

TSMC generated 54 percent of sales last quarter from components used in communication devices and 16 percent from computing chips, according to a company presentation. Santa Clara, California-based Intel got 63 percent of sales from PC chips and less than 1 percent from mobile devices.

Intel, which both designs and makes its own chips, is trying to catch up in the mobile space with the Atom series aimed at tablets. The series was later into the market than products from competitors such as Qualcomm, making it difficult to convince mobile device makers to use its offerings.

“TSMC has emerged as a key supplier benefiting from handsets because it allows its customers to offer powerful application processors and communication chips,” said Randy Abrams, who rates the stock outperform at Credit Suisse Group AG in Taipei. “Being independent for all its individual clients and chip designers will help it keep its strong supplier position in the future.”

To contact the reporter on this story: Tim Culpan in Taipei at tculpan1@bloomberg.net

To contact the editors responsible for this story: Michael Tighe at mtighe4@bloomberg.net; Christian Baumgaertel at cbaumgaertel@bloomberg.net