About 28.4% of US homeowners owe more on the mortgage than

their house is worth, real estate data firm Zillow said this month.

美國房價 跌回10年前水準

美國標準普爾公布的調查報告指出,繼去年最後一季美國房價下跌3.6%之後,今年首季繼續下跌4.2%,調查指出,今年3月美國前20大城市中,有19個城市房價比1年前下跌。其中跌幅最深的是明尼阿波利斯,達10%。其次是鳳凰城下跌8.4%,芝加哥7.6%,西雅圖7.5%,坦帕6.9%,夏洛特6.8%,克里夫蘭6.3%,邁阿密6.1%。唯一上漲的是底特律,比去年上漲0.8%。經濟學家預估,年底前至少還會再下跌5%。

據該調查,全美房價指數已連續第八個月下跌,從房市泡沫以來的房價跌勢更甚經濟大蕭條時期,而在經濟大蕭條時期過後,房市大約花了19年才真正恢復元氣。

去年夏季在政府鼓勵購屋的稅賦優惠下,房價暫時反彈回升,但從優惠方案退場後又開始跌價。最新報告顯示,全美多數地區房價已經「二次衰退」。經通貨膨脹因素調整後,房價指數更跌至1999年以來最低紀錄。

Read more:世界新聞網-北美華文新聞、華商資訊 - 美國房價 跌回10年前水準

3月房價大跌 專家:年底前再跌5%

June 01, 2011

在法拍屋充斥、待售房屋眾多以及人們缺乏意願或者沒能力購屋等諸多因素下,全美3月份房價大幅下跌,為自從2002年來的低點,凸顯房市仍然在困境中掙扎。

史坦普/席勒20都會區房價指數顯示,全美大都會區房價指數跌至九年新低,20個都會區中,多達18區3月份房價下跌,而且其中12個地區的房價跌至2006年房市泡沫化以來最低點。經濟學家預估,年底前至少還會再下跌5%。

目前共有12個都會區房價跌至將近四年新低,包括紐約、明尼亞波利斯、亞特蘭大、芝加哥、底特律、拉斯維加斯、邁阿密、鳳凰城等;其中,明尼亞波利斯市情況最糟糕,房價下跌3.7%,其次依序是夏洛特和芝加哥2.4%、底特律2%。有些地區不跌反漲,包括西雅圖上漲0.1%、華盛頓地區1.1%。華盛頓地區是過去一年中,房價唯一上升的大都會。

據該調查,全美房價指數已連續第八個月下跌,從房市泡沫以來的房價跌勢更甚經濟大蕭條時期,而在經濟大蕭條時期過後,房市大約花了19年才真正復元。

去年夏季在政府鼓勵購屋的稅賦優惠下,房價暫時反彈回升,但從優惠方案退場後又開始跌價。史坦普公司指數委員會主席貝里茲認為,最新報告顯示,全美多數地區房價已經「二次衰退」。經通貨膨脹因素調整後,房價指數更跌至1999年以來最低紀錄。

許多經濟學家認為,全美房價年底前至少還會再下跌5%,在待售法拍屋存量減少、雇主開始更大量的召募員工、銀行放寬借貸門檻以及潛在房屋買主有信心認為購屋是明智的投資之前,房價不太可能停止下跌。

富國銀行(Wells Fargo)資深經濟學家威奈爾說,人們取得房貸困難重重,也許明年初房價才會落底。

Read more:世界新聞網-北美華文新聞、華商資訊 - 3月房價大跌 專家:年底前再跌5

Real House Prices and Price-to-Rent: Back to 1999

by CalculatedRisk on 5/31/2011 12:35:00 PM

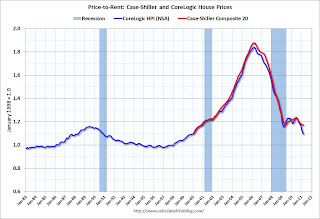

Case-Shiller, CoreLogic and others report nominal houseprices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 1999/2000 levels.

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2011), and the monthly Case-Shiller Composite 20 SA (through March) and CoreLogic House Price Indexes (through March) in nominal terms (as reported).

In nominal terms, the Case-Shiller National index is back to Q3 2002 levels, the Case-Shiller Composite 20 Index (SA) is slightly above the May 2009 lows (and close to June 2003 levels), and the CoreLogic index is back to January 2003.

Note: The not seasonally adjusted Case-Shiller Composite 20 Index (NSA) is back to April 2003 levels.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to Q4 1999 levels, the Composite 20 index is back to October 2000, and the CoreLogic index back to November 1999.

A few key points:

• In real terms, all appreciation in the last decade is gone.

• In real terms, all appreciation in the last decade is gone.

• Real prices are still too high, but they are much closer to the eventual bottom than the top in 2005. This isn’t like in 2005 when prices were way out of the normal range. In many areas – with an increasing population and land constraints – there is an upward slope to real prices (see: The upward slope of Real House Prices)

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners’ Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through March).

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through March).This graph shows the price to rent ratio (January 1998 = 1.0).

Note: the measure of Owners’ Equivalent Rent (OER) was mostly flat for two years – so the price-to-rent ratio mostly followed changes in nominalhouse prices . In recent months, OER has been increasing – lowering the price-to-rent ratio.

. In recent months, OER has been increasing – lowering the price-to-rent ratio.

. In recent months, OER has been increasing – lowering the price-to-rent ratio.

. In recent months, OER has been increasing – lowering the price-to-rent ratio.On a price-to-rent basis, the Composite 20 index is back to October 2000 levels, and the CoreLogic index is back to December 1999.

Fall in house prices raises fears for US economy

• Recovery hit by drop in consumer confidence

• US house prices back to 2002 levels

• US house prices back to 2002 levels

US house prices have fallen for the eighth month in a row. Photograph: Robert Galbraith /Reuters

US house prices have fallen back to levels last seen in 2002 and consumer confidence has also fallen sharply according to new figures, leading to fresh fears about the country's economic recovery.

A closely watched measure of the property market, Standard & Poor's Case-Shiller home price index, has fallen for eight months in a row and declined by 4.2% in the first quarter of 2011, following a 3.6% fall in the fourth quarter of 2010.

By the end of March the index hit a recession low and showed an annual decline of 5.1% compared with the first quarter of 2010.

According to the survey, nationally home prices are back to their mid-2002 levels. Prices in Atlanta, Cleveland, Detroit and Las Vegas are below January 2000 levels.

The US economy had been showing a better than forecast recovery but the Conference Board, an industry group, said its index of consumer attitudes fell to 60.8 in May from a revised 66.0 in April, well below economists' forecasts for 66.5. A third survey also suggested that growth could be slowing.

Ken Goldstein, Conference Board economist, said the figures were evidence that consumers were worried about jobs, food prices and housing. "These are not good numbers, we are back to where we were two month ago. But I think we are bobbing along the waves, not sinking further."

Business activity in the heartland mid-west grew much less than expected last month as sales and employment weakened. The Institute for Supply Management-Chicago business barometer dropped to 56.6 in May, its lowest reading since November 2009. The reading was 67.6 in April, and economists had forecast a May reading of 62.6.

"The question is, 'Is the softer data we're seeing transitory, or is it likely to persist throughout the remainder of 2011?' Right now, that's an open question that investors are trying to figure out," said Michael Sheldon, chief market strategist at RDM Financial in Westport, Connecticut.

Prices of single-family houses in the 20 largest US cities fell 0.2% from February to March on a seasonally adjusted basis, according to the Case-Shiller index. Year on year house prices fell in 19 of the 20 big cities polled by Case Shiller when compared with March 2010.

Minneapolis saw a 10% annual decline, the first market to experience a double digit drop since March 2010 when Las Vegas was down 12% on an annual basis.

Washington DC was the only city where home prices increased. Housing in the capital was up 1.1% on a monthly basis and 4.3% over the year. Seattle was up a modest 0.1% for the month, but still down 7.5% against March 2010.

About 28.4% of US homeowners owe more on the mortgage than their house is worth, real estate data firm Zillow said this month.

"This month's report is marked by the confirmation of a double-dip in home prices across much of the nation," said David Blitzer, chairman of the index committee at S&P Indices. "Home prices continue on their downward spiral with no relief in sight."

Blitzer said that since December 2010 an increasing number of markets had hit new lows. In March 2011, 12 cities – Atlanta, Charlotte, Chicago, Cleveland, Detroit, Las Vegas, Miami, Minneapolis, New York, Phoenix, Portland (Oregon) and Tampa – fell to new lows for the current housing cycle.

A rebound in prices seen in 2009 and 2010 was largely due to a tax credit for first-time home buyers, he said. Excluding that policy he said there has been no recovery or even stabilisation in home prices since the recession.

沒有留言:

張貼留言